Determining whether your company requires venture capital and, if so, at what stage? Here’s how to seek it the right way.

Identifying a problem worth solving and developing an idea worth conceptualizing:

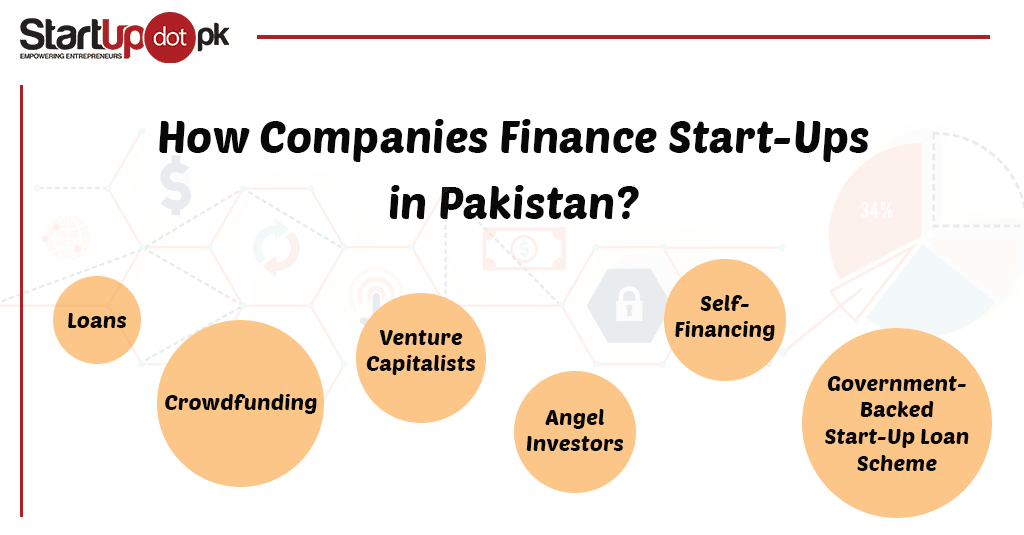

These are the two major components of a problem-solution fit. Once your mind is clear of questions like: who will be the target of this product or service; does it solve the consumer’s problems; and how will the solution be delivered to the consumer? You move on to the bigger questions like: how much money do you need, do you need to raise funds or take a loan? Here is a checklist that your progressive business should go through before embarking on a journey of raising funds.

-

Acquiring customers

At this level, traction and momentum are frequently more significant than money. It’s your responsibility as an entrepreneur to convince capitalists that the market has responded favourably and that there is proven demand for your product by leads. You may further consolidate your preposition by suggesting a strategy to acquire clients efficiently and with healthy profit margins.

-

The Business has Matured

At the seed stage, there are higher expectations. Investors are interested in your business’s culture, the workings of your administrative team, and your strategy for increasing your market share. They want to read your business plan and believe you are well informed regarding the market and how you plan to expand in it. You want to prove you will be able to easily manage when the business scales. This include showing how the business will be legally structured, what your operational expenditures will be, the equipment you’ll require, how the business will generate money, and more.

-

Growth Potential

Avoid being short-sighted by only planning ‘how to get your business of the ground’, instead you should chart out the business’s projected growth over the course of next five years. This will give the investors a better understanding of the potential your business holds. A business with a high growth forecast is of much more value to investors than a business with higher revenues but no potential.

-

Reached the Right Time

Premature scaling of a business is a recipe for disaster and one of the biggest reasons behind the frequent failure of start-ups. Growing your business at an early stage often leads to poor fiscal management, resulting in a vicious cycle of losses. Companies that look like they have built out too fast and exhausted their budgets are mostly turned down by investors as they in the rush of time forget to perfect their product offerings.

Factors to Consider when Searching for a Venture Capitalist:

As the saying goes “You never have a second chance to make a first impression.”

Capitalists expect entrepreneurs to be prepared. They write big cheques to only a few start-ups, hence an entrepreneur making the most out of this opportunity should engage them with a refined pitch clearly conveying the idea and potential of the business.

Entrepreneurs must be well-prepared when approaching capitalists with a pitch for funding. You must provide detailed information about your start-up, as misinformation can lead to distrust resulting in rejection of the proposal for the investment. The following steps should be considered before approaching an investor.

-

Put Yourself in an Investor’s Shoes

Even though your idea may be great, you need to evaluate the proposal from the perspective of an investor. This will enable you to understand what the investor is seeking and design your pitch accordingly. Unnecessary use of jargons will only lead to misunderstandings. You must clearly and effectively describe your business plan to investors so that they can fully comprehend it even if they are unfamiliar with the industry to which your product belongs. This will instantly let investors know that the entrepreneur is making a great effort to engage them.

-

Know your Pitch

While investors may have faith in your company, their investment is ultimately a tool for their own financial gain. As a result, it’s crucial to underline how directly investing in your business would benefit them. Have your fundamentals in order before you pitch. The simplest way to stand out and capture the investor’s interest when pitching to an established firm or other businessman is to demonstrate clearly how and when they will gain from their investment.

-

Flexibility, not recipes

Each entrepreneur has a strategy for how they intend to structure their business and their investments. However, it’s important to remember that different investors, as well as the other stakeholders, have different expectations. You will be able to reach a settlement and create a mutually beneficial agreement if you are flexible throughout the negotiations and prepared to handle any objection or counter-offer made to you.

-

Narrowing Down Options

Reach out to only the ‘Right’ investors. Raising equity is time consuming and interferes with your ability to run your firm effectively on a daily basis. Narrow down Capitalists that invest in industries similar to yours and focus on them. Every Venture Capitalist firm has a specific niche that they invest in. They may target specific sectors of the economy, businesses of a certain size and age, or businesses located in particular geographic boundaries. Or any combination of the aforementioned factors. Most venture capital firms explicitly state out their target investment profile on their websites. Make sure you fit that profile before reaching out to them to save everyone’s time and money.

The Advantages of Seeking out Venture Capitalist Funding:

Funding from a venture capitalist has additional advantages beyond just raising money. Several advantages are stated below.

-

Experienced Leadership and Advice

Investors offer more than just capital. They can do everything from allowing you to create connections to convincing them to promote your start-up idea throughout the world. Many entrepreneurs who leave their companies go on to become partners at venture capitalist firms. They are a valuable resource for new owners because of their expertise in developing a business, dealing with everyday issues, and analysing financial performance. Experienced investors often serve as strategic advisors to their portfolio companies’ management teams. This can reduce financial risks. Having a seasoned advisor to guide you when a problem arises can improve the odds of making a sound decision.

-

Limited liabilities

You will not need to pledge personal assets in order to obtain money. Seeking funds from venture capitalist is different from other start-up funding sources where you have to put up your private property as collateral (for example loans from traditional banking institutions).

-

Networking Opportunities

Founders who are extremely busy typically do not have a lot of time to develop the strong professional networks that are a great resource for businesses. To support the businesses they are investing in, venture firm partners, however, they spend ample amount of their time strengthening their networks. Having access to these contacts can assist you in forming new business relationships, expanding your clientele, raising future rounds of investment, and hiring employees.

-

No Obligation for Repayment

A venture capital firm invests in your start-up because it will receive equity from the business if sold. As a result, you will not have to make repayments and will have more funds directed towards investing in expanding your business. There is no obligation to repay the funds because it is not a loan, therefore you are not solely responsible for it if the start-up is not able to succeed.