The Myth Behind Customer Acquisition Cost [CAC] and Life Time Value [LTV]

Most of the emerging entrepreneurs in Pakistan have startup ideas related to E-commerce or subscription services.

However, the very grave mistake which they make is that they are unaware of the cardinal concepts on which their success is dependent.

Today, we are going to explore two (02) core concepts and see how they will help us scale and sustain our startup idea. Furthermore, how they will help us become prepared for the questions which judges ask in startup competitions.

What You Should Know About CAC?

CAC is Customer Acquisition Cost which is the cost you have to pay to convince one customer to buy your product or service. It can be calculated by totaling the cost of sales, marketing, salaries and any other cost that you have put in the advertisement of your product or business, in a given time period. This cost will be divided by the number of customers you had, in that time period. The answer will be your CAC.

Example

Let’s say you opened up a boutique shop. To promote it, you will put up ads in the newspaper, project pictures of clothes on the billboards, use the web or give brochures to spread the word. The total cost of printing of the brochures, renting of the billboards, using photographers for taking pictures of the clothes, and all the other revenue spent on the advertisement is Rs. 1000/- in one month time period. In this one month time period, the customers that came to the shop and bought the clothes are 100. So you will divide the total cost i.e. Rs. 1000/- by the number of customers you acquired i.e. 100.

This makes your CAC or Customer Acquisition Cost to be Rs 10/-

The Problem

Fine, now you do know the Customer Acquisition Cost, now what? This value helps you understand that how much more money you need to spend to get more customers and scale your business. Let’s say you want 500 customers then you just need to spend 500 x 10 = Rs. 5,000/-

See! That’s how simple is it !!!

Still, the problem is how can we know that what is the worth of one customer to us? How much money can we make from the customers which we are acquiring? This is where LTV comes into play.

The Invaluable Knowledge About LTV

LTV stands for Life Time Value which is the value of a customer and how much profit you are going to acquire from him. It will help you predict the net profit that you will make from that customer in his lifetime. The higher the LTV, the more valuable is the customer. You can calculate LTV by taking the money you made from the customer and subtracting from it the money you spent on obtaining the customer. This will give you the profit sum.

Example

Let’s assume we have two customers. One customer (Customer A) has signed a one month contract while the other customer (customer B) has signed a six month contract with us. Customer B is going to pay us more since he is staying longer, so his LTV will be higher than customer A.

If we spent Rs. 1000/– (CAC) on both customers then Customer A paid us Rs. 5000/– and therefore his LTV will be Rs. 5000/- minus Rs. 1000/- i.e. Rs. 4000/-

If customer B paid Rs. 12,000/– then his LTV will be Rs. 12,000/– minus Rs. 1000/– (CAC) i.e. Rs. 11,000/- Therefore, Customer B is the more valuable customer and as a small business you have to make sure you have lots Customer B’s to ensure stable revenue chains.

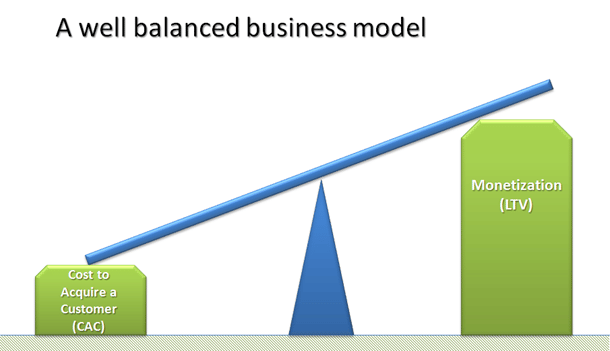

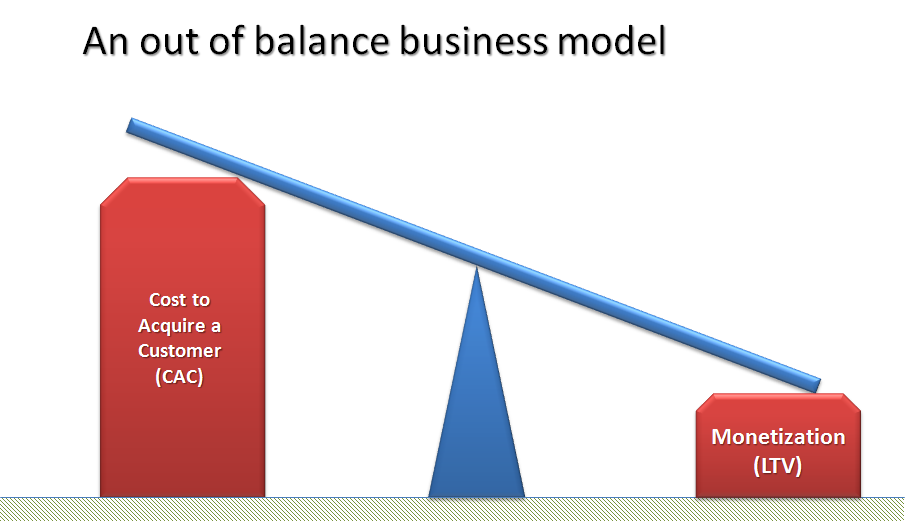

The following diagrams will help clear concepts:

As a startup founder, it is your responsibility to think how you can lower your CAC

Your Success Depends on Your Understanding and Proper Implementation Of CAC and LTV

- Categories:

- Ecosystem