Do you know? Only 1% of startup pitches turn into funded deals.

Delivering the Right pitch can make or break your chances as a startup founder. Pitching is the lifeblood of fundraising—investors receive hundreds of decks, but invest in only a few. What sets successful founders apart is not just their idea, but how well they craft and execute the Right pitch that speaks to investors’ needs.

This guide offers a practical, dense, and actionable approach to crafting and delivering a compelling pitch that helps you avoid common mistakes and stand out.

Why Delivering the Right Pitch Matters to Investors

| Concept | Insight |

| Idea vs. Execution | Investors care more about how you execute than your original idea. Show traction, product-market fit, and a scalable path forward. |

| Investor POV | Tailor your pitch to what investors care about: risk mitigation, ROI, alignment with their portfolio, and exit potential. |

| Your Job | Your main goal in the first meeting is to earn a second one. Avoid making it about you make it about the opportunity. |

Right Pitching Strategies: What to Do vs. What to Avoid

Nailing your pitch isn’t just about confidence it’s about preparation. Practice and structure go a long way. Investors want to see real traction, a credible team, and a clear market strategy not just big dream. Make your ask specific, anticipate tough questions, and never rely on improvisation. A solid pitch shows you’re not only passionate but also prepared to build something that lasts.

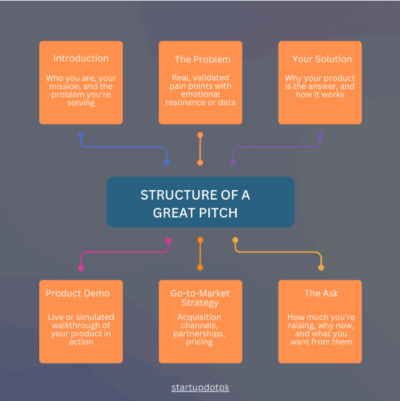

How to Structure the Right Pitch for Startup Success

A great pitch isn’t just about what you say it’s about how you structure your story. The most effective pitch decks follow a clear, logical progression that answers the key questions investors have. Start strong with an introduction that defines who you are, your mission, and the real problem you’re solving. Walk them through the pain points with data or emotional resonance, then introduce your solution with clarity. Highlight the market opportunity with TAM/SAM/SOM insights and back it up with a compelling product demo. Your business model, traction, and go-to-market strategy should prove sustainability and growth potential. Show you’re ahead of the competition, backed by a capable team. Then, present your financials transparently and close with a confident ask. This structure not only keeps investors engaged it builds trust and momentum.

Key Investor Questions (And How to Prepare)

Investors may ask simple questions, but they’re looking for deeper answers. Each one reveals what truly matters to them from timing and team strength to scalability and ROI. Use this table to understand what they’re really asking, so you can tailor your responses with clarity and confidence.

| Question | What They’re Really Asking |

| Why now? | Is the timing right for this startup to succeed? |

| Why you? | Do you have the grit, talent, and experience to win? |

| How big is the opportunity? | Is this a venture-scale business? |

| What’s the exit potential? | Will I make money on this investment? |

| Who else is on the team? | Can you build and lead a winning team? |

| What are your traction and metrics? | Is there any proof this will work? |

| How will you use the money? | Do you know how to responsibly scale? |

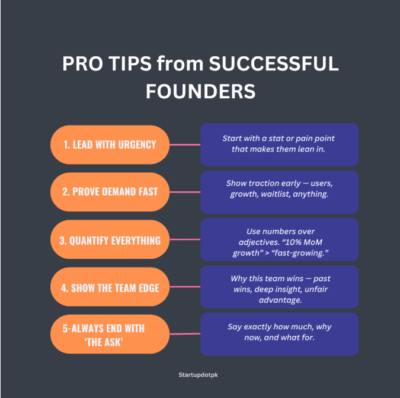

Pro Tips for First-Time Founders

Fundraising is as much about mindset as it is about preparation. Set realistic expectations: it’ll take longer, and you might raise less than planned. Be open to advice, not just capital, and treat every rejection as valuable feedback. Support your journey with the right mentors and keep your data room ready it signals professionalism and helps you stay one step ahead.

Final Words: Pitch Like You Mean It

There’s no magic formula just clarity, preparation, and confidence. Ditch the fluff. Avoid buzzwords. Say what you mean, back it with proof, and respect your audience’s time. Investors aren’t looking for perfection; they’re looking for conviction, evidence, and a team that knows how to execute. This guide gave you the structure now it’s your job to bring the energy.

You’ve got this. Best of luck out there!